2019 State of the Industry Report

Bob Crossen is senior managing editor for Water & Wastes Digest. Crossen can be reached at [email protected].

Generally speaking, the WWD State of the Industry Report pulls on the status of the U.S. economy and budgets to develop conclusions about how wider societal issues impact the narrower industry focus of water and wastewater. In 2018, water and wastewater professionals lamented the lack of an infrastructure bill that could inject money into the industry to push projects over the finish line. While new construction was not on the docket for most, upgrading facilities was, and that continues to be the case moving into 2020.

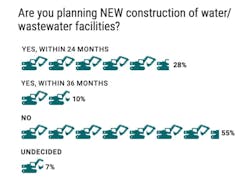

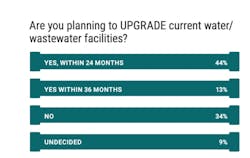

In fact, 56% of respondents to the 2019 WWD State of the Industry Survey said they were not planning new construction for 2020. But on the other side of that coin, 57% said they were planning to upgrade within the next 36 months. Even more impressive, 44% of respondents said those upgrades would occur in the next 24 months, which suggests an immediacy for upgrades.

It would seem that despite the slow movement at the federal level on funding resources, projects are still being completed. This highlights two key takeaways from industry thought-leaders interviewed for this report. First, the water and wastewater industry is surprisingly resilient to economic downturn due to the critical functions of water and wastewater management in society. And secondly, state level action and funding programs are seeing an uptick in replacement of federal programs.

When it comes to economic resiliency, Paul Turgeon provides a broad perspective with his business experience. Turgeon has led several water treatment companies in his career and served as a board director for Anue Water Technologies, BWA Water Additives, U.S. Water, and MFG Chemical, among others.

“At the end of the day, the products are still needed to keep plants running or to keep producing water, so while there may be a drop in demand for consumer goods or the other aspects and issues that occur with a recession, we are fairly insulated from it,” Turgeon said. “The fact is plants are running. They need water. They need clean water. It’s fairly recession-tolerant: the water industry.”

As for state level action, CEO and Co-Founder of 120WaterAudit Megan Glover has the records to show state-level legislation and regulation efforts are increasing year-over-year.

“We tracked 30 new states’ legislative bills just around lead sampling in schools and LCR [Lead and Copper Rule] across the U.S. and that doesn’t even count additional PFAS bills,” Glover said, noting her company has maintained a legislation tracker for three years. In just this past year, she witnessed “an increase of over 100% if not a 200% increase in the bills that were proposed last year.”

These two issues are compounded by other notable trends in the industry, specifically mergers and acquisitions, industrial and private system growth, and the increasingly intensifying buzzword that is smart water.

In 2018, smart water made a big splash at the American Water Works Assn. Annual Convention & Exhibition (AWWA ACE), where virtually all signage at the show directed attendees to the next smart water solution. That messaging continued and intensified in 2019, as companies launched new customer interfaces, proved the success of their artificial intelligence (AI) and machine learning algorithms, and took smart water issues deeper by discussing the quality of that water as well as the non-revenue water applications.

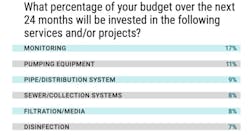

Respondents to the WWD State of the Industry Survey answered what percentage of their budget would be spent on several types of equipment. Topping that chart was monitoring equipment (17%). It was followed by pumping equipment, pipe and distribution systems, sewer and collection systems, and filtration and media equipment. The correlation between the smart water messaging and these budget allocations seems to strongly suggest smart water is not only an exciting prospect for manufacturers; it also is desirable for utilities.

“It’s growing more and more outside of just AMI projects that are smart water projects that are into capital planning and GIS and other categories of smart from the smart meters,” David Wachal said. “It is definitely moving from this smart meter movement to this bigger concept of a real-time utility.”

The desire for smart water systems does not stop at the public or municipal market, however. Private industrial systems—such as oil refineries, mining operations, and food and beverage facilities—also want to be smarter. Kevin Milici, vice president of marketing and technology for U.S. Water, said smart cities technology also makes for smart businesses where the bottom line is top of mind.

“The industrial demand for water solutions is getting more robust over time,” Milici said, noting this growth led to U.S. Water’s acquisition of Tonka Water a few years ago.

Smart Water

Non-revenue water, smart water, digital twin, monitoring networks and all the other terms and methods associated with smart water got more airtime in 2019. Solutions providers are jumping at the chance to be the next big tech start up with machine learning and AI platforms or integration systems. Companies like Mueller Water Products are expanding their offerings to include more robust dashboards to connect all its devices together. Meanwhile, companies like Fracta—which developed an AI solution for leak detection—received investment from Kurita Water.

While conversations to this point have mostly centered on smarter systems to measure volume of water and detect leaks, the next step and layer is analysis of detailed customer information and smart water quality systems. David Wachal, director of global water practice for ESRI, echoed that sentiment.

“You’re starting to see new companies in that space pop in to start providing more technologies specifically around water quality collection and analysis,” Wachal said. “There’s the pressure that the utilities are getting from the customers to be more efficient and relay the cost of water, where it is and generally provide better service because that’s what people expect.”

The primary challenges and barriers to implementing these smart systems are the speed of evolving technology and the vast number of products and services available. With so many smart water solutions, it is no wonder utilities are in a mode of decision paralysis. For a utility trying to effectively and properly manage its taxpayer money, not investing in smart water can be an easier decision than making a costly investment in the wrong service or product. It is incumbent on smart water providers to not only build trust with their clients but also provide long-term robust solutions that are meaningful to utility ratepayers. This is driving interest toward smart water quality and customer usage platforms because the information is desired by the ratepayer who wants to better understand the investment.

Wachal said connecting data also is a gap when it comes to smart water systems and the evolution of smart cities. Each department in a municipality may be collecting data, but opening that data across departments is not as common. Some cities have implemented these kinds of programs to great effect, however.

Mergers & Acquisitions

Nearly every month in 2019 brought with it some kind of business merger or acquisition. For example, Kurita Water acquired U.S. Water and as mentioned earlier in this report, Kurita also made an investment into the AI company, Fracta. Other notable acquisitions include Advanced Drainage Systems acquiring Infiltrator Water Technologies, Kemco Systems acquiring Water Resources Inc., and Franklin Electric acquiring First Sales LLC.

Turgeon said with the perceived value of potable water growing in the face of water scarcity and water quality issues, investors and scholars are seeing considerable interest in the water and wastewater industry.

“Water has been a segment of investor interest for quite some time now,” Turgeon said. “The needs are complex, which drives innovation and intellectual property, and that’s not going to change in our lifetime.”

While being on the ground floor of new intellectual property and potential patents—which can pay off greatly for investors—Turgeon said investing in water companies has additional advantages. Capital investments in water and wastewater solutions providers are an investment in helping the world at its foundational level; these investments help safeguard the globe’s most precious resource. As the perception of water’s value continues to rise, so too does the value of the equipment that ensures water’s safety and sustainability.

“From an investment point of view, water is an undeniable resource requirement of the future and it just makes almost infinite sense that it’s a space that people will want to continue to invest in,” Milici said.

Turgeon said he expects 2020 will continue to see investor interest in the industry, as well as mergers and acquisitions movement

“Investors can count on having less variability with their investment,” Turgeon said. “Beyond that, generally there’s a lot of money invested with private equity companies. Private equity companies are pretty darn good at finding businesses that could be available for acquisition and have a good investment thesis around an acquisition or a merger. So there’s easy market efficiency there.”

Milici said investors also seek to broaden portfolios so their money is not tied to any one particular bucket. With the attractiveness of the water sector, corporate sustainability, going green and other similar cultural values rising, expanding investments into an area where those values are a matter of business is an easy sell.

Election Year Effect?

The U.S. Presidential election is on the horizon as the country and Congress gear up for the primary elections in spring. As often is the case during an election year, most movement in Washington, D.C. stalls while Congressional members hit the campaign trails to garner voter support. Additionally, Congress members generally will not push a bill across the finish line unless it will bolster their re-election. Turgeon said from a macro level and investment standpoint, it is unlikely that the election year will change the investment dynamic currently witnessed in the water and wastewater industry.

“If we look along the dimension of ‘Will it have a material impact that will change the investment dynamic or the attractiveness of the segment,’ my mind goes to ‘No,’” Turgeon said. “It’s not going to change that.”

Turgeon said in recent board meetings he has attended, the mention of a focus on state-level action has become a talking point. Because so little is likely to happen at the federal level, it follows that the focus falls upon the states. And as already noted by Glover, state-level regulations and legislation are already on the rise.

Turgeon said prevalent water issues hit close to home, and that aligns with Glovers comments as she expects the focus on states will continue in 2020 as regional water quality and infrastructure issues continue to gain importance.

“I do think at a federal level we will reach a standstill,” Glover said. “At the state level, that’s where all the action is going to happen, both proactive as well as reacting to the Lead and Copper Rule revision. In my opinion, what we’re going to see over the next quarter is probably all we’re going to see at the federal level.”

Glover said some last minute funding pushes leading into 2020 could make for a good strategic move on the part of incumbents. And that seems to be the case as the House of Representatives recently held a markup session of House Resolution 1497, one of only a handful of funding measures on the table before the primary election. This early draft includes language that would introduce $16.68 billion to the Clean Water State Revolving Fund over the next five years if enacted. While the bill would be handed down from the federal level, the state level involvement cannot be ignored.

Lead & Copper Rule Revisions

There have been several regulatory changes or updates of note this year at the federal level, namely the introduction of the National Water Reuse Action Plan and the repeal of the Waters of the U.S. Rule. The impact of those both deserve merit and mention in this report, but the proposed revisions of the Lead and Copper Rule are perhaps a more immediate concern for municipal leaders and plant operators. Among these revisions are five key areas of change, according to Glover:

1. Population levels that require lead sampling requirements;

2. Mandated lead service line inventory, both private and public;

3. Required lead sampling in every school and childcare facility, both private and public, within a utility’s jurisdiction;

4. Customer notification and data transparency rules; and

5. Oversight teams for primacy agencies.

Of these five elements, Glover said the mandate of pipe inventory and lead sampling in schools and childcare facilities are the two greatest undertakings. For one, many rural systems are lacking a map or tools to determine where the pipes in their networks are or what materials comprise them.

“Quite frankly, the data just does not exist currently for both sides of material type,” Glover said. “Even the best of utilities that have been doing asset management plans and [have been] tracking their material are certainly not tracking the private side.”

This presents a market opportunity for companies that can not only find the pipe, but also determine its material. And this would also have to be done with pipe on private property as well, which leads to the revision on sampling schools and childcare facilities. Glover said utilities may not know the exact locations of these facilities or how many there are within their districts. Although the revision says sampling will scale—20% each year until 100% are tested annually—the cost of conducting these tests would stress many utilities.

As for customer notification and data transparency, Glover said many water utilities use paper records, and showing audit trails and public transparency of results and timelines, could be an added burden for those utilities.

Bringing the issue back to the state level, Glover said how states will tailor the Lead and Copper Rule revision to suit their needs could have a large impact, as well.

“What the states do with the Lead and Copper Rule revisions, that is going to be very interesting to follow,” Glover said. “We believe that there are many states that will go further than the proposed Lead and Copper Rule revisions and create stricter standards at the state level.”

Industrial System Scale & Corporate Sustainability

The biggest change in the industrial sector, Milici said, is the size of the systems. Private companies are starting to ask for equipment on larger scales as they increase production and seek to manage their industrial water and wastewater better.

“Many of the industrial applications and systems are getting bigger and more complex,” Milici said. “We see the industrial space going nowhere but up in a similar fashion [to the municipal space], actually probably at a faster rate.”

Furthermore, the corporate sustainability movement, he said, is not one he feels is facetious. While what is good for business has not always been good for the environment, the mindset is starting to flip: what is good for the environment is good for business.

“They’re making really clear metrics and objectives, quantified objectives for what they want to accomplish,” Milici said.

HP, for example, announced it is dedicating $200 million in the next five years to develop water-based ink technologies for digital printing to reduce industrial water pollution. Goals like these, Milici said, are becoming important to industrial and private companies for both business and environmental responsibility reasons.

“We can do both. We will do both as a country, as a society, [and] as a culture,” Milici said.