By all accounts, 2022 was among the busiest years for the water and wastewater market in recent memory. The Infrastructure Investment & Jobs Act — referred to as the Bipartisan Infrastructure Law (BIL) by the U.S. EPA — at the tail end of 2021 injected hope, optimism and excitement into an industry that had not received investment on this scale since the 1970s.

But, as often is the case, the regulatory environment shaped how that money was likely to be spent. The Presidential administration placed an emphasis on lead service line replacement and the removal of per- and polyfluoroalkyl substances (PFAS) from drinking water and wastewater systems. In fact, the latter received an updated Health Advisory in June, but an expected Maximum Contaminant Level (MCL) in December is still yet to be published. PFAS came to overshadow the lead service line conversations on a national scale with talk of impending regulations, and an EPA proposal to name the family of contaminants hazardous substances in accordance with the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) also known as Superfund. With impending research into the effects of PFAS in biosolids being conducted by the U.S. EPA, the national conversation will not end anytime soon.

This heightened focus on new regulations regarding PFAS raised the profiles of communications professionals throughout the industry. Utilities are challenged with how to communicate the nuance of these regulations to their customers. For example, the PFAS Health Advisories are orders of magnitude smaller than any other Health Advisories in history, which begs the question from utility customers, “Is my water safe to drink?” Unfortunately, for many utilities, detecting at that level is not possible — let alone treating to that level — and the answer could induce panic in systems that are otherwise compliant and producing a healthy product.

But utilities are not the only entities in the market struggling to find a foothold in their regular activities. The effective date for Build America, Buy America in May only resulted in guidance in early November from the U.S. EPA. This lack of information gave manufacturers pause in fulfilling equipment sales. For some, this is due to equipment manufacturing outside the U.S., while others that manufacture inside the U.S. have components from international suppliers and are uncertain how to calculate domestic production of their systems to comply with the new law.

Waivers have been established to overcome some of these hurdles but, without clear guidance from the Made In America Office on certain definitions and calculations, the industry may feel a lag in execution and a stretching of timelines in 2023, despite funding disbursements reaching the states.

In terms of funding, by November, the U.S. EPA had issued BIL funding for state revolving funds to more than 30 states after approving their intended use plans. Examples include New York State, which announced $176 million in funding for water and wastewater projects, and Illinois where $70 million will fund the first quarter of fiscal year 2023 with $11 million in principal loan forgiveness. These are just two instances of disbursement, but it is indicative of the money finally flowing to the communities that need them. How that will interact with industry headwinds from the regulatory side will be a continued conversation throughout 2023.

Survey overview

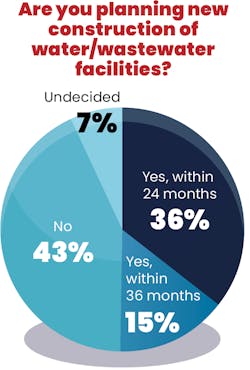

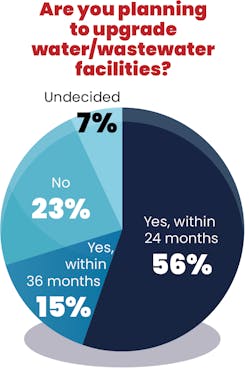

As for those purchasing decisions, 36.07% indicated they will construct new facilities within 24 months — an increase of 12 points year over year — and 14.75% said they will do so in 36 months — a drop of three points year over year. This suggests the 36 month timelines have remained the same for a portion while others have more urgent construction. The answer for No Construction fell seven points year over year to 42.62% from 49.6%. As for upgrades, completing them within the next 24 months maintained the highest response rate (55.74%) year over year with an increase of 13 points. Upgrades within 36 months fell six points, suggesting a conclusion to construction timelines as new projects. In either case — new construction or upgrades — the injection of funding to the industry appears to be showing an increased attention on construction of facilities due to available funds.

That position indicates greater optimism for 2023 as well. For 2022, 14.75% of respondents said the year was very good while 23.33% of respondents believe 2023 will be very good. That increase appears to come from 2022’s Good (54.10%) and Mediocre (19.67%) responses. Zero respondents indicated their organization’s health in 2023 will be Poor; Very Good (33.9%) and Excellent (15.25%) made up the majority of responses.

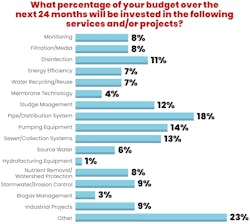

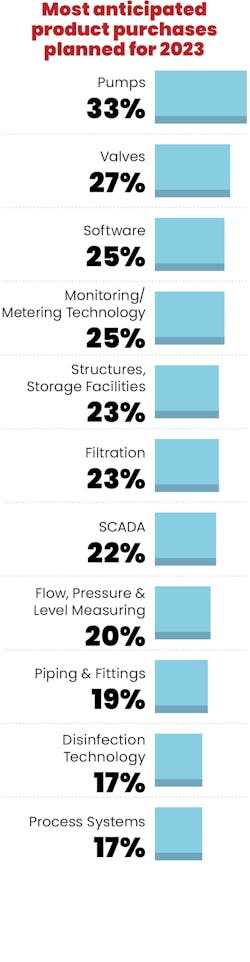

As for equipment or services to be purchased, the top five in order are: Pumps (33.33%), Valves (26.79%), Software (25%), Monitoring/Metering Technology (24.49%) and tied for fifth are Structures, Storage Facilities (22.45%) and Filtration (22.45%).

As the U.S. EPA set its sights on regulating PFAS, its actions created new challenges for water and wastewater utilities. This was most notable with the announcement of the new health advisory levels for four PFAS in June 2022, which included PFOA, PFOS, PFBS and GenX in concentrations as low as 4 parts per quadrillion.

This announcement is only the start of a series of PFAS regulations anticipated by industry professionals, which includes Maximum Contaminant Levels and Maximum Contaminant Level Goals for drinking water, and new Effluent Limitation Guidelines for wastewater discharges. EPA is also studying the impacts of PFAS in biosolids on public health to make a determination on regulations there as well.

And perhaps most critical to the future of PFAS in water and wastewater is EPA’s proposal to add PFOA and PFOS as hazardous substances under the CERCLA also known as Superfund. EPA has stated its intentions with this move is to put pressure on PFAS producers by opening a regulatory door to take action against them for polluting.

Industry associations and regulatory professionals, however, have voiced concern that the language as it was submitted would place a liability burden on utilities for PFAS discharges, due to their role in removing the contaminant from waterways. A hazardous substances designation also presents challenges for destruction and disposal of PFAS-laden wastes such as biosolids or spent filtration media, as it carries additional regulations for how the wastes are handled. Every major association submitted comments with concerns about the language as it was written, while also noting the importance of holding polluters accountable.

The last item on EPA’s actions for 2022 was a memo to state administrators on how to use current National Pollutant Discharge Elimination System (NPDES) permitting regulations to monitor and permit agencies with PFAS in mind. This memo included exact methods for monitoring and answered looming questions as the industry awaits final updates to the Effluent Limitation Guidelines.

Communications rise to the national stage

The PFAS health advisory levels announcement put utilities into a bind because, while it was not regulatory nor was it enforceable, it caused utility customers to question the safety of their water and responding to their questions was a difficult proposition. Communicating this, along with compounding communications needs for developing a workforce, initiating projects to repair or replace aging infrastructure, and other regulatory changes, accelerated the role of communications professionals in the utility sector.

“That, as a communicator, is something that makes me a little nervous, because the first time that we’re communicating with our communities cannot be around these really potentially scary or contentious issues,” Corso said.

Instead, Corso recommends utilities communicate regularly using existing channels to explain current infrastructure projects, proactively share lab results, and tell the stories of the utility. In doing so, the channel will be primed with the trust needed to share and communicate sensitive information. This also means working more collaboratively with the local news outlets to communicate the nuances and reach a broader range of customers than just the utility’s channels.

Corso said communicating is like a bank account. As a utility communicates regularly, it is building up savings of trust in itself from its customers. Then, when a negative issue has to be addressed, the bank might deplete in trust some, but the built up trust will keep the utility from going into the negative, which would create a woefully uncomfortable communications situation.

“We have to continually be making trust deposits into that public trust bank account because we’re going to take a ding when those things come up,” Corso said, “and not because people don’t necessarily trust us. It’s just because these are things that they don’t understand and that sounds scary, and they don’t have the same background and context that we do.”

There are more regulations on the horizon that will require communications from utilities — PFAS in biosolids, effluent limitation guidelines, etc. — making this an important investment for water and wastewater utilities in the coming years.

OEMs seek clarity on BABA

Another regulation taking center stage is Build America, Buy America, a domestic preference law codified by the Infrastructure Investment and Jobs Act. This law — referred to as BABA — works in addition to the American Iron and Steel Act, which plays a similar role. BABA created three categories of products: construction materials, iron and steel products, and manufactured products. In terms of domestic preference, 55% of each item in each category for any project that accepts federal dollars must be domestically manufactured.

“That is the area that has caused, in our estimation, the biggest amount of confusion,” Mahan said. “Not knowing whether we’re going to get clarity in weeks or months or at all, I think that is an area that we’re certainly interested in getting a little more clarity on.”

While guidance is still forthcoming, the EPA has created a system of waivers to keep projects moving in the meantime. In total there are five waivers, which each play different roles. The first two are for the State Revolving Fund (SRF) projects and for Water Infrastructure Finance and Innovation Act (WIFIA)-funded projects that were initiated before the May 14 enactment date, meaning those projects are waived from complying with BABA if they applied for and received a waiver. The third is a small projects waiver for projects under $250,000 in total costs. Fourth is a de minimis waiver, which applies to small pieces of equipment such as nuts and bolts, meaning those items would not need to comply with BABA. And finally there is a six month adjustment period waiver for non-SRF and non-WIFIA projects.

Mahan said this structure essentially created a pathway for projects to move forward in 2022, but noted project timelines are likely to be delayed or extended in 2023 and beyond due to the lack of regulatory guidance and no additional waivers.

“In the midst of inflation, in the midst of supply chain challenges, there’s concern that there could be an added cost associated with this,” Mahan said. “All of these concerns, in our view, have off ramps to ensure that we can be true to the intent of the provision, but do it in the way that takes into account the unique attributes of the water sector.”

In an effort to keep projects moving and the money flowing from the infrastructure bill, major industry associations and companies — WEF, AWWA, Xylem and others — sent a letter to the EPA requesting a two-year delay in implementation, so guidance and implementation can be completed. This delay would also give time to equipment manufacturers to pivot any processes necessary to comply with that guidance as well. At the time of publishing, the Office of Management and Budget had taken up the mantle of crafting the BABA guidance and had requested input from utilities through WEF and AWWA with the intent of publishing guidance in early 2023.

SRF funding streams surge

Despite the regulatory confusion surrounding BABA, states began to receive and disseminate funding to projects through their respective state revolving funds. In a press release, the EPA cataloged a handful of its achievements for its first year of BIL funding. Among those achievements are $4 billion in funding for SRF programs, a $5 billion non-competitive grant program for small systems to address emerging contaminants such as PFAS, and $1 billion for cleanup at Superfund sites.

The momentum looks to be continuing into 2023 as evidenced by the responses to the WWD State of the Industry Survey. However, there is some caution to consider with continued flow of the funding as it relates to BABA regulations. Mahan noted the possibility for extended project timelines and delay in projects, should guidance for BABA see further delays.

And, even with that guidance, delays are still a likely reality as equipment and solutions providers adjust to the regulations to comply and capitalize on the funding. The foundation has been laid and the opportunities are in sight, and now is the time professionals should look to seize their moment.

About the Author

Bob Crossen

Bob Crossen is the vice president of content strategy for the Water and Energy Groups of Endeavor Business Media, a division of EndeavorB2B. EB2B publishes WaterWorld, Wastewater Digest and Stormwater Solutions in its water portfolio and publishes Oil & Gas Journal, Offshore Magazine, T&D World, EnergyTech and Microgrid Knowledge in its energy portfolio. Crossen graduated from Illinois State University in Dec. 2011 with a Bachelor of Arts in German and a Bachelor of Arts in Journalism. He worked for Campbell Publications, a weekly newspaper company in rural Illinois outside St. Louis for four years as a reporter and regional editor. Crossen can be reached at [email protected].