Compliance Complications

Regulations are becoming more strict, and industrial facilities around the world are trying to keep up.

As industrial facilities seek cost-effective and sustainable changes in processes, water reuse often provides an appealing option. Likewise, as municipalities seek cost-savings, they often require industrial users to reuse their greywater.

“For instance, if a local government must invest some number of millions of dollars to expand a municipal water treatment plant, a large portion of their consideration is in regards to population growth and large industrial users,” said Ryan Tingler, regional sales manager for MPW Industrial Services Inc. “It may turn out to be increasingly economical to ask a large industrial user to accept an alternative source that requires additional treatment at the plant as compared to upsizing the municipal water treatment plant.”

According to the Texas Commission on Environmental Quality, industrial facilities can reuse treated greywater for a number of purposes: process water, landscape maintenance, dust control, toilet flushing and other similar activities. Using greywater for feedwater is a popular option, and, notably, irrigation, as well. Depending on the availability of “purple pipes” (i.e., how close a facility is built to a recycled water pipe system), industrial facilities may direct greywater to a purple pipe system to cost-effectively reuse water, and, ultimately, meet the municipality’s demands.

“Reuse of greywater is a big growing trend we’ve seen,” Tingler said.

Greater Recovery

Water reuse is not a lone option as industrial facilities face water scarcity. As the costs of water rise, industrial consumers expect brine recovery rates to be in a smaller range.

“Municipalities are facing increasing pressure for discharge water qualities while having tighter budgets,” Tingler said. “Common practice in helping to balance a budget is to increase revenues. Municipalities’ primary method of increasing revenues is to increase the cost of the treated water going out to users and/or increasing the cost of the water coming back from those users that requires additional treatment. As both the feedwater and sewage water costs for a large industrial user continue to rise, they look for alternative methods to save for the sake of their budget. To do this, they have to perform a combination of accepting less treated water from the city and place less waste water down the drain. An excellent method in doing this at many industrial sites is to increase the recovery in processes such as reverse osmosis (RO).”

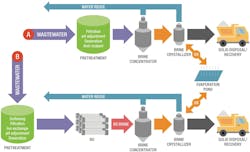

According to Water. Desalination + Reuse, traditional brine recovery recovers 75% to 80% of water in its first RO stage. It then moves on to an energy-intensive, thermal evaporative stage. However, new technologies are being developed.

“There have been technological advances that now allow these systems to recover as much as 95% in particular circumstances,” Tingler said. “Often, this can result in hundreds of thousands of dollars saved annually.”

Market Growth for ZLD

China’s rapid industrial growth has forced government intervention through regulations and the same can be said for industrial wastewater discharge.

Prior to these regulations, facilities would discharge water directly into freshwater sources with minimal treatment, leading to high salt and mineral content and damage to the environment. Officials passed laws requiring facilities to meet strict discharge regulations.

Industrial facilities, most notably thermal power plants producing flue gas desulfurization (FGD) wastewater, are required to meet zero liquid discharge (ZLD) to comply with environmental regulations in China. And, recently, those requirements have become stricter, as the solids produced at the end of the ZLD process must be further purified so they can be repurposed.

However, China’s environmental issues were not the first catalyst to drive ZLD adoption. The technology’s beginnings date back to the 1970s in Colorado, where discharge from power plants was having a similar effect on water quality.

U.S. Beginnings

Heritage businesses of Suez Water Technologies and Solutions, formerly GE Water & Process Technologies, pioneered ZLD around 1970 with a focus on power plants built in the Colorado River basin. William Heins, global leader of market development for Suez, said the influx of power plants discharging their industrial wastewater—like cooling tower blowdown—into the river basin was cause for concern.

“Those power plant discharge streams have a higher salt content than the river, and if you have too much discharge into those rivers, the salt content would go up,” Heins said. “That was becoming a concern from both a water scarcity standpoint, and it was starting to raise the salt levels in the waterways.” Raised salt levels can have negative effects on freshwater fish populations, which could throw the basin’s ecosystem out of balance.

To combat this, development teams sought a means to reduce the amount of water discharged from these plants and recover water for other processes.

These two issues were seen as beneficial for the environment and the power plants. By reusing water from their own processes, the power plants need less freshwater, saving costs associated with pumping more into their system. It also alleviates water scarcity concerns as more freshwater remains available for potable and recreational use.

At the time the technology was developed, the first critical pieces of equipment were brine concentrators—essentially vertical tube falling film evaporators—that evaporate the wastewater and distill it into a purified stream of steam. This water often is 10 ppm or less in total dissolved solids (TDS), which leaves a concentrated brine stream that is 10% or more total solids. Heins said this concentrated brine is considerably saltier than sea water, so it still cannot be discharged and requires more treatment.

That stream is then processed through a crystalizer, which further evaporates the brine to precipitate the salts that are finally dewatered to become a mixed-salt solid. Those solids then can be brought to landfills for disposal.

But as Heins noted, China has made an effort to require further treatment of this solids waste because standard landfills in China will not accept the mixed-salts. Instead, Chinese regulations call for plants to purify those solids for other uses in an effort to eliminate them from the solids waste stream.

MCL standards for the most hazardous heavy metals.

Salt Sale & Energy Barrier

“If you have to be that pure,” Heins said of mixed-salt solids waste, “you might as well make them even more pure and use them as a salable product, and that’s really what we’ve been doing in China.”

Suez is not the only company recognizing this trend either. The bigger question when it comes to sale of these solids is the end use. Finding a target market for this product has remained a struggle for Chinese companies.

“It’s easy to say you’re going to make these salts, but the market for these salts, I don’t think has developed,” said Dan Bjorklund, vice president of industrial concentration and desalination for Aquatech. “The value of products such as sodium chloride and sodium sulfate is very low.”

Making these solids pure enough to sell requires a lot of energy, particularly in the evaporation and crystallization processes. Because of the energy costs associated with this, facilities in some areas of the world are reluctant to adopt the technology.

Jim Matheson, CEO of Oasys Water Inc., said similar concerns were raised with other technologies, such as RO, for seawater desalination in its outset, but through continued development of the equipment, it became more efficient and those issues became a footnote. He said this trajectory is likely to be the same for ZLD.

“They found out ways to reuse that energy [in RO treatment]. The same thing is happening here [with ZLD],” Matheson said of RO for desalination, noting evaporators traditionally were used in that process. “Now that we’ve gone to RO, the energy consumption for seawater desalination dropped significantly—we expect and we’ve demonstrated that bringing new technologies into industrial water treatment has reduced the total cost for ZLD, but also brought down energy consuption.”

Opportunities in India

Much like China, India’s industrial growth has been quick, largely went unregulated as it grew, and now requires ZLD in certain facilities. Kelly Lange-Haider, technical service and development leader for Dow Water & Process Solutions, said textile operations have been a great opportunity to introduce ZLD at industrial facilities.

“[There are] a lot of opportunities there for ZLD, especially with the types of waters that you can generate from the ZLD process. They’re well-suited for some of the specific industries that have needs in India, and I’m thinking textiles, specifically,” Lange-Haider said. “In the textile industry, they have the ability to use a higher-TDS salt water type product as part of their manufacturing process.”

Bjorklund said coal-fired power plants in India also are seeking ZLD technology as they produce FGD wastewater.

“India is in the process of installing FGD scrubbers on their coal fired power plants with ZLD blowdown systems, so that’s another market that’s a growth for ZLD at this time,” Bjorklund said.

Potential in the U.S.

Since ZLD’s introduction in the 1970s in the U.S., regulations surrounding the technology have been left to the states. Those states facing the greatest water scarcity issues, namely California and Arizona, have regulations requiring some form of ZLD for power plants.

Despite being almost entirely surrounded by water, Florida also has some freshwater scarcity issues. Heins said ZLD has grown in popularity in the peninsula.

“Pure water down there is at a bit of a premium because they have a lot of seawater intrusion,” Heins said. “Their water table is not that great.”

Matheson, Bjorklund and Lange-Haider also noted the highly regional nature of ZLD in the U.S., but unlike China and India where regulations are driving adoption of the technology, regulations do not look to be a key mover in the U.S., particularly at the federal level.

President Donald J. Trump has been vocal about his desire to terminate many U.S. Environmental Protection Agency (EPA) regulations, and has made some moves on that front since taking office in January—like eliminatnig the Office of Surface Mining’s Stream Protection Rule. With those motives well-known, it is unlikely that federal regulations will be instituted regarding ZLD in the near future.

While regulations may not drive certain regions of the U.S. market for ZLD, Matheson said applications still are available. One such market is in hydraulic fracturing, also known as fracking. This process uses a lot of water, and Matheson sees fracking operations as potential candidates for ZLD projects.

“Those discussions and the regulatory framework [around water treatment in fracking] is very early and very much state-by-state,” Matheson said. “The EPA has, over time, ruled on [water treatment and use in] the power industry. But right now, in the oil and the gas industry, the EPA has largely not ruled, and its very much driven by state regulations.”

On the Move

When it comes to NPDES restrictions, the “root of [it] is the word ‘awareness,’” Tingler said. Instruments can now measure heavy metals at lower levels in water streams, bringing greater attention to water quality. This awareness amounts to stricter discharge limits.

Facilities face a few options—of varying costs—when navigating NPDES restrictions. Every option must be analyzed on a case-by-case basis, according to Tingler. Plants may transfer solids to a landfill, but this amounts to different costs for which a facility may not have accounted. Alternatively, a power plant on a large river may collect its waste on a barge and transfer it to a treatment facility that can treat large volumes of water affordably.

When attractive options are not available, facilities turn to mobile water treatment. Leased or temporary treatment vendors offer flexibility. When a facility requires water treatment for a project with an indeterminate time frame, leased technology can work around the facility’s schedule.

“Mobile equipment on wheels or leased commercial agreements provide a lot of flexibility to the end user to make a decision today that solves a problem, but then gives them the flexibility in the future to move as market conditions change,” Tingler said.

For example, to avoid obtaining discharge permits, peaking power plants rely on vendors to transport and treat their waste. Or, additionally, as power plants close coal combustion residuals (CCRs) ponds, commonly known as coal ash ponds, in response to stricter regulations, vendors provide a needed service. Mobile equipment can treat and dispose of their wastewater from the cleaning of air heaters.

According to the EPA, CCRs risk leaking contaminants into groundwater. CCRs need regulation, and facilities must comply. EPA regulates coal ash disposal with requirements including:

- Groundwater monitoring around surface impoundments and landfills;

- Liner requirements for new surface impoundments and landfills to protect groundwater;

- Groundwater cleanup from coal ash contamination;

- The closure of unlined surface impoundments that are polluting groundwater;

- The closure of surface impoundments that fail to meet engineering and structural standards or are located too close to a drinking water source;

- Restrictions on the location of new surface impoundments and landfills so that they cannot be built in sensitive areas such as wetlands and earthquake zones; and

- Proper closure of all surface impoundments and landfills that will no longer receive CCRs.

Transferring the responsibility of treatment to an outside vendor also unburdens the facility from the responsibility of obtaining permits and meeting regulations. Power plants are a key example of this trend. New plants are not designing water treatment systems into the initial plant design. To build the plants quickly, save costs and maximize profits, plants leave water treatment systems out of the design as a simple remedy. The plants are designed to make power, and the water treatment is assigned to an outside vendor.

While facilities shift the regulatory burden to vendors, vendors profit. Stricter regulations amount to a greater demand for outside vendors, which gives the vendors a monopoly.

“They prosper off regulation, and obviously to the detriment of the actual industrial end user themselves,” Tingler said.