About the author:

Bob Crossen is the senior managing editor for Water & Wastes Digest. Crossen can be reached at [email protected].

When reflecting on 2021, it is hard to not see it as one of the most important years for the municipal water and wastewater industry in the past decade or more.

The industry continued to contend with the coronavirus pandemic, saw the publishing and delay of the Lead & Copper Rule, witnessed the proposed Fifth Unregulated Contaminant Monitoring Rule, reflected on poor grades from the American Society of Civil Engineers Infrastructure report card, felt optimistic about President Joe Biden’s American Jobs Plan, and is now preparing for a $55 billion injection from the Infrastructure Investment and Jobs Act.

These federal regulations, rules and laws will create a fundamental difference in the industry moving forward. The momentum is clear, and it is even reflected in the responses to the Water & Wastes Digest Annual State of the Industry Survey.

Respondent Demographics

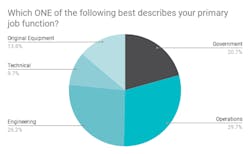

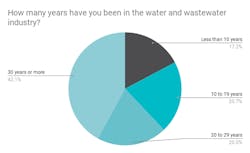

This year, 145 members of the WWD audience responded to the survey. Government Administration & Corporate Management accounted for 20.69%; Operations made up 29.66%; Engineering was 26.21% of the respondents; Technical amounted to 9.66%; and Original Equipment Manufacturers (OEM) made up the remaining 13.79%.

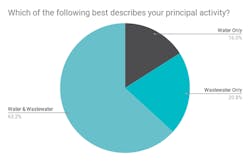

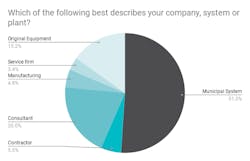

As for the sectors in which those respondents work, 63.2% conduct work in both water and wastewater, 16% are water only and 20% only work in wastewater. The principal activity of the respondents’ organizations broke down as follows: Municipal System (public or privately-owned) 51.03%; Contractor 5.52%; Consultant 20%; Manufacturing Facility/Industrial System 4.83%; Service firm 3.45%; and OEM 15.17%.

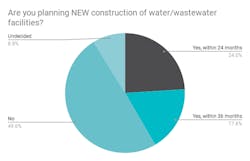

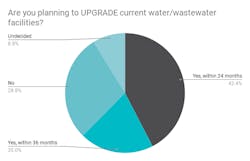

Also notable is the continued trend toward upgrading facilities rather than building new ones. Results showed 24% of respondents over the next 24 months (24%) and 17.6% of respondents over the next 36 months would seek new construction. 49.6% said they would not conduct new construction and 8.8% indicated they were undecided.

Those figures were flipped when it regarded upgrades however as 42.4% said they would upgrade within 24 months while 20% said they would upgrade within 36 months. Only 28.8% said upgrades were not on the table, while the same percentage (8.8%) indicated they were undecided. These responses were provided prior to the passage of the IIJA, and it is not clear how or if that funding would impact the responses now.

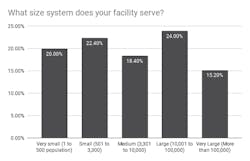

As for the sizes of the systems results indicate 20% are Very small (1 to 500 population); 22.4% are Small (501 to 3,300); 18.4% fall into the Medium (3,301 to 10,000) category; 24% are Large (10,001 to 100,000) systems; and 15.% indicated they are Very Large (More than 100,000). This is an interesting spread as respondents are evenly distributed across community sizes, although pairing sections together, 60.8% of respondents serve communities of 10,000 people or fewer.

This provides some tangential context to one of the biggest and most important challenges of the year. Smaller systems have smaller workforces, and retaining current workers — let alone hiring them — has been a constant conversation in 2021, and not just in the water industry.

Workforce & Resignation

National news organizations have used the term The Great Resignation to refer to the workforce issues seen in 2020 and 2021. After nearly two full years of the coronavirus pandemic, short staffs and increased tension on the work/life balance, employees have been quitting their job en masse. There are some cultural reasons for this as well as societal ones, but important to note are some of the WWD SOTI Survey figures that inform this as well.

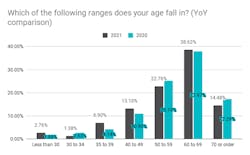

Of the 145 respondents to the survey, more than 50% are 60 to 69 years old (38.62%) and 70 years old or older (14.48%). Comparing just those two age ranges to 2020’s report, there was a decrease in those 70 years old or older of nearly 3 points from 17.29%. Additionally the 60 to 69 saw a small increase from 37.97% in 2020. The 50 to 59 age bracket also dropped from 25.19% in 2020 to 22.76% in 2021.

This small changes to the older age brackets redistributed to the bottom of the age curve with sizable increases in 35 to 39 (6.9% in 2021) and 40 to 49 (13.1%), which in 2020 were 4.14% and 10.9%, respectively. Last year, WWD indicated the figures meant people were working later in life and that in doing so, the younger age brackets were unable to move into positions of purchasing authority. Seeing the redistribution this year, suggests there have been retirements and promotions of younger industry professionals to fill in the gaps.

Keith Oldewurtel, Veiola NA executive vice president and chief operating officer for the municipal and commercial markets, indicated this was the case for his teams.

“The early retirements, we've seen an acceleration of that,” Oldewurtel said. “[As for] recruiting I would say we are still able to fill positions but we probably are running with more open positions.”

Recruiting, Retention & Wages

But with younger generations will come cultural shifts and changes. Digital products, services and solutions will continue to gain prominence, and younger people are also invested in their jobs if they see their work impacts real change for society at large.

Recruiting and retention strategies will need to change to meet these individuals where they are, and it is already creating challenges for many employers in water and wastewater.

WWD has heard numerous anecdotes from OEMs and municipalities alike that if they can even get applicants to apply, getting them to show up for interviews and even show up for the first day on the job are not foregone conclusions.

“You have a lot of opportunities that are out there in the marketplace and it doesn't seem to be a lot of people and I think oftentimes what you're getting is people applying for jobs and then having other opportunities,” Oldewurtel said. “So you know, they may not be as quick to sign up for a job because they've got two or three balls in the air.”

Additionally, the market place is competitive for talent because of the struggles of employers to hire the talent they need to meet the market demands. Without the right values or right pay, workers move to where they see greener grass. Kurita America CEO Lamarr Barnes said his company has felt this impact and noted there are several reasons for this workforce trend.

“I think during the pandemic people with transportable skills have seen the opportunity to perhaps make more money,” he said. “And we've certainly lost some people from that classic [of] ‘move to another job and make 10 to 20% more.’ You see especially at the more entry-level jobs a lot more competition and the need to pay better. So we've found it difficult in our entry level, especially production jobs.”

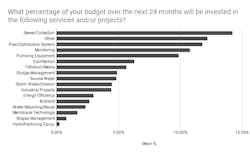

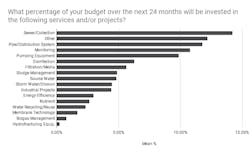

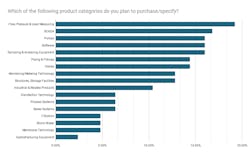

On this note of pay, one of the interesting findings for this year’s survey was in how respondents indicated they would be spending their budget in 2022. While Sewer & Collection Systems led this category with 14.2% indicating they would be spending budget on that infrastructure, the second highest response was Other at 12.19%. Of those responses around one third indicated they would be spending their budget on wages or salaries in 2022.

Barnes said Kurita Americas has handled the wage concern by adjusting its pay rates for entry level jobs, but those raises do not happen in a vacuum. The people around and above those employees will then also seek more pay, creating a domino effect through the organization.

For those in a similar boat, it is important to note that the Infrastructure Investment & Jobs Act includes $25 million for the Water Infrastructure and Workforce Investment Grant Program over a five year period. Perhaps with such a grant program, employers in the industry can offer more competitive wages than ever before to entice more workers to the industry and keep current ones in their positions with more effective pay structures.

Bob Cappadona, Veolia North America executive vice president and COO for VNA's waste management business, said recruiting and retaining employees is further complicated by the effects of the coronavirus pandemic.

“In our business, it's tough to get an employee out in the field or out into one of our facilities, without a significant investment of time, training, personal protective equipment, on the job training…” Cappadona said. “It's a steep ramp up. That has been a challenge in the current environment as well. And then part of that is — which has been through for the entire year and a half or so — COVID precautions. Even today we are reiterating to our team of all the things that we need to do to make sure that we remain COVID safe.”

Cappadona said these COVID-safe strategies result in loss of work for employees for set periods of time when they test positive, which makes manpower planning to run facilities more critical than ever. He noted that recruiting and retention strategies are also evolving within the context of the pandemic, a shift seen from other industry organizations.

Austin Alexander, vice president of sustainability and social impact for Xylem, also noted this particular change and said that Xlyem is taking both an internal and external view of the situation. Not only does the company want to recruit younger talent, it also wants to make sure its messages to external parties resonate properly. The younger generations have a greater affinity to digital products, technologies, and communications behaviors that impact more than the internal hiring strategies of the company.

“As we're rolling out more technology that is digitally focused, we're moving our workforce to find talent that is digitally native … as well as making sure our workforce is increasingly diverse and representative of the communities in which we are operating,” Alexander said.

This focus on diversity and inclusion is not a new concept. It was one of the largest trends in 2020 following several events of civil unrest that year. Companies like Xylem as well as associations like American Water Works Association and Water Environment Federation, to name a few, have elevated internal teams and committees to review these initiatives within their organizations to create goals and strategies for the whole organization.

From a technology standpoint, Alexander said the younger generations have expectations about workflow that quite simply did not exist five to 10 years ago.

“They expect to see, on your cell phone, which pump station is down,” Alexander said. “We see that already as the workforce is starting to fold over and so for our technology, we need to match that as well. That real-time data, real-time assessment, being able to manage your assets remotely are going to be key pieces of the workforce transition.”

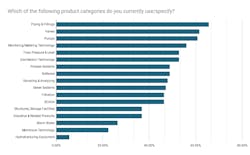

The WWD State of the Industry Survey backs up this technology acceleration and transition. Flow, Pressure & Level Measurement, SCADA, Software, and Sampling & Analyzing Equipment were all listed in the top five technologies that respondents plan to purchase. Following closely behind that was Monitoring/Metering Technology.

Generational Values Impact Hiring Strategies

While related to the issues of recruiting, retention and wages, aligning company and organizational strategies with the values of the next generation of workforce has become a growing and ubiquitous conversation in the water and wastewater sector.

In WWD’s Young Pros program, which highlights 10 rising stars in the water and wastewater industry each May, those awarded the recognition always note the importance of societal values for their generation. Millennials and Generation Z have an affinity toward environmental protection, improving the lives of their neighbors through their actions, and social programs to raise the floor for people’s quality of life.

Alexander said all of these values correlate perfectly with the future the water and wastewater sector sees on the horizon.

“I think the waters sector’s secret weapon for talent acquisition is who we are and what we do,” Alexander said. “Water has for so long, way too long, been thought of as the not sexy area to work in, but we are a sector completely devoted to providing clean access to water to all populations and protecting the environment from pollutants. And that in itself is a story as a sector that will attract younger generations, and we're seeing it in Xylem.”

RELATED CONTENT WWD YOUNG PROS 2022

This is exemplified in the hiring process, she added. Job requirements and duties are discussed at the top of those interviews and are immediately followed by value conversations to ensure the organization’s values are in line with the potential employee’s values.

“They'll talk about the job for about five minutes and they want to know about our sustainability programs or diversity, equity and inclusion programs, volunteering programs,” Alexander said. “And I think that is how we as a sector need to lean in on that secret weapon that you want to solve the world's greatest environmental and equity challenges.”

Cappadona, Barnes and Oldewurtel all noted a similar expectation from new recruits as well as the value proposition for working in such a critical industry for humanity’s future.

Climate, Sustainability & Green House Gases

A heavy focus for Xylem in 2021 and beyond is providing the tools, expertise and advice necessary for utilities to reduce their greenhouse gas emissions and carbon footprint. Alexander said Xylem has approached this subject from two perspectives. First, Xylem made a net zero commitment for greenhouse gas emissions on Sept. 30, 2021, a move Alexander said positions and further strengthens the company’s goal as a sustainability leader.

“But as we were also getting into our own commitment and just speaking with other utility leaders and industry leaders are out in the sector, we were really finding, hey water has a big role to play here,” Alexander said. “Water is often talked about in the form of resiliency and adaptation, but really never brought to the forefront in mitigation and the upfront abatement of emissions.”

The research Xylem conducted resulted in a white paper that identified 2% of greenhouse gas emissions are due to water and wastewater utility processes and that close to 10% of global greenhouse gas emissions can be tied to water use management, which includes industrial, commercial, agriculture, etc.

These findings, Alexander said, informed the mission Xlyem has set out to fulfill.

“If we're really going to address this, we have to do our part as a company: make a commitment,” she said. “But we see there's even a bigger impact if we can help the sector mitigate up front and really bring water to the forefront of discussions on climate change mitigation.”

A start for utilities, she said, is simply improving energy efficiency. Optimizing motor usage, pump run times, controls equipment, lighting, etc. This topic has been an underlying focus to practically all utilities for several years as they have sought to do more with less. Improving efficiency of energy usage means lower overhead costs and potential to focus that money into other investments.

On the more advanced side is better use of the digital technologies with near real-time or real-time monitoring, smart water technologies, remote access SCADA systems and data analytics. These digital tools, she noted, can have a drastic impact on overall system operation to reap benefits that feed into a greenhouse gas emissions reduction plan.

“It can help you make real-time operation decisions that can help you run more efficiently and save pretty considerable amounts on electricity,” Alexander said. “We have that today. That technology is here. So that can make some big cuts in a lot of cases, and save money for utilities.”

Managing the Unknown With New Communication Strategies

With younger employees placing high value of climate, sustainability, and diversity, equity and inclusion, companies are having to adapt and change. But it goes even beyond those values because society is also experiencing change from a sourcing, and economic standpoint.

Cappadona said his sector of the industry is one that generally has not felt the impacts of major economic shifts to the same degree as other industries. But the pandemic has changed that.

“We've got to do things in terms of managing commodities in a different way a than we've done in the in the past,” Cappadona said. “And frankly, we need to have a dialogue with our customers that's different than in the past. Many of our customers are not used to inflation in our industry and that's a different conversation than some of our customers are used to and candidly some of our employees are used to delivering to our customer.”

Due to the pandemic, Cappadona said Veolia workers have had to embrace the unknown and get comfortable being uncomfortable because the pandemic has steered everyone into uncharted territory. From establishing remote work options for those positions that allow for it, to candid conversations on the economy and its impact on fulfilling customer orders, and even opening communications channels between any level of employee and Cappadona himself.

Starting in March 2020, he said the company adopted a policy that any employee can call, text email or in some way ask Cappadona and other higher-ups questions, particularly because the uncertainty was a stress point.

“At that point, employees were concerned about what does it mean for their job? What does it mean for their health?” Cappadona said. “We're in an industry where 90% of our employees can't work from home. In many cases, we're out responding to the same hospitals that you're seeing on at the evening news.”

This, he said, runs the risk of employees saying they are simply not comfortable with the work and potentially refusing to do the work entirely. By opening up that communications channel, employees were able to gain deeper clarity of their work and a greater sense of stability in their job.

Supply Chains & Materials Prices

Job security and work stability have not been the only areas with great levels of uncertainty.

“I don't have the crystal ball to tell you what the economy is going to look like in the second half of 2022,” Cappadona said. “I certainly didn't have the crystal ball to predict where we we’re going to be relative to it.”

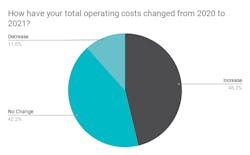

Supply chain issues became a national conversation because of the impact to the consumer, but those same problems have impacted the water and wastewater industry. Between tariffs of the past several years and now the back-up in the ports, materials pricing has increased and the timing to receive them has stretched.

Barnes said that for Kurita, the company felt the impacts of this from multiple angles. On the equipment side of the business, he said they saw four-week timelines extend to 12 weeks, so he said his team had to get creative with sourcing to shorten those timeframes. The price and availability of steel, he said, is most notable and has been one of the bigger sticking points.

Despite those challenges, he said things have generally been manageable for the company.

Oldewurtel shared similar experiences to Barnes, noting that controlling deliveries and meeting schedules presented considerable challenges. In terms of meeting schedules, he also noted that the tight labor market has also impacted the number of contractors responding to work and the speed at which that work could be conducted.

As for Kurita American, on the chemicals side of the business, Barnes said price fluctuations were impossible to predict and created a volatile market.

“Some key finished goods that we blend into a final finished good or intermediates have been difficult to get,” Barnes said. “For things that are being imported, maybe there's some domestic supply, but [given] the significant amount of imported supply and when that important supply is disrupted, there's not enough domestic product to go around. There's a lot of allocations, and a lot of fast, moving pricing changes.”

Barnes pointed to amines for corrosion inhibition, organic phosphate products and suspension polymer as some chemicals that — at the time of the interview in November 2021 — were in short supply. He did note, however, that practically every imported material was impacted in some way.

“So it's been kind of various things and it changes week-to-week,” he added. “Propylene glycol has been in short supply all around the country here recently, for instance, but probably will come back eventually. So it comes and goes.”

Bock from Anue Water also pointed at the raw materials prices as creating business headaches, and added they have been further complicated by company policies in some cases. As an example, he said one of the suppliers he works with placed a 15% upcharge on materials costs for what the company deemed “pandemic procurement.” That cost, he said, ultimately gets passed on to the purchasing authority.

“It certainly is the cause for some detailed discussions with the end user and nobody likes it,” Bock added, “but everybody reluctantly understands it.”

Optimism in Check

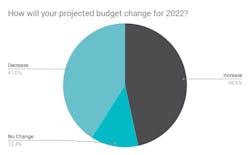

Despite the workforce headwind, respondents to the survey were overwhelmingly optimistic about 2022.

Of the 145 responses, 70% indicated 2021 was a Good (43.45%), Very Good (20%) or Excellent (6.9%) year for their organization. Looking to 2022, those numbers show increased optimism with Good (42.07%) remaining in the same ballpark as 2021 figures while Very Good (31.72%) and Excellent (9.66%) saw strong increases.

These responses were taken before President Biden signed the IIJA into law, so it is also safe to say that optimism will be even higher due to the funding increases to programs for the sector. However, that funding does not come without some big hurdles, namely supply chain concerns and the expansion of Buy America language for federal programs.

OEMs throughout the industry have lamented the supply chain issues for their products, which has strained their cash flow and backed up their orders for months at a time. And this will only be further compounded by Buy America language expansion, which requires at least 50% of a product be domestically produced. That number will increase by 5% year-over-year to 75% in 5 years, and OEMs have raised this as a point of concern.

Not only are supply chains strained but domestic iron and steel manufacturing may not be able to meet the demand for domestic products, particularly because Buy America is not limited to the water and wastewater industry. Roads, bridges, rail, airports and all other infrastructure programs will also be subject to this, meaning water resources will be competing against all other infrastructure for materials.

Expect many conversations in 2022 about sourcing materials and opening shipping bottlenecks because without solutions to those problems, the infrastructure funding may be quite the challenge to even spend.