Editor's Note: The images of the charts have been updated due to errors in the NEW construction and UPGRADE construction figures previously presented. 2/22/2024

2023 was a year of change for Wastewater Digest. The brand assumed a new name and realigned its content with a renewed focus on the clean water market, specifically for municipal wastewater treatment operations, management, design and construction.

Wastewater Digest conducted its annual survey of its audience on the state of the wastewater industry in September and October of 2023. In total, 105 professionals across the country took part in this survey with questions about respondent demographics, budget intentions and likely equipment purchases.

Respondent demographics

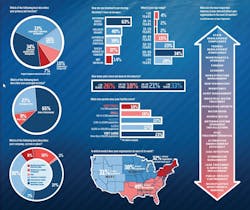

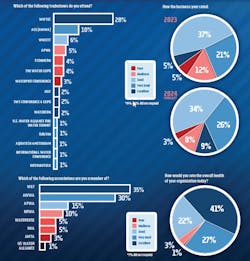

Of the 105 wastewater industry professionals who took the survey, more than two-thirds (67%) indicated they were either Executive/Administrative Management (34%) or Engineering & Operations Management (33%), meaning the vast majority of survey respondents are managers with direct reports. Operations (16%) and Engineering & Design Staff (10%) also responded, and the fewest responses came from Original Equipment Manufacturers (7%).

Municipal or County-Owned Water Systems (37%) and Private/Investor-Owned Water Systems (7%) made up the bulk of the respondents by company type. Second to that were Contractors or Consultants (30%) with Manufacturer or Supplier of Equipment (16%) constituting the majority of the remaining responses.

In terms of principal activity, a similar number of respondents (65%) said they cover both Water & Wastewater, which follows logically as executives and managers likely have direct reports across the utility regardless of discipline. With that said, more than a quarter (27%) said they were Wastewater Only professionals, while Water Only professionals made up 9% of respondents.

Overall, these numbers show that the following charts, graphs and inferences on average reflect the thoughts and feelings of municipal or county-owned systems administrators and managers who manage both the drinking water and wastewater aspects of their utilities.

Workforce, hiring & retention

When Wastewater Digest editors looked past the regulatory and funding headlines of 2023, there was one common thread underlying practically every industry conversation: workforce.

Throughout the year, utilities and industry professionals continued to bring this issue up in conversations, particularly when asked about the greatest challenges facing their organization. It was common to hear that finding good operators was difficult. Even harder was keeping them on staff before they left for something else. Despite workforce retention programs that pay for education, licensing and exam fees, the workers would complete those programs and accept a job at a neighboring utility that was paying more.

Filling the workforce pipeline for the water industry is more critical than ever, as the State of the Wastewater Industry Survey results once again showed that nearly half of all respondents were 60 years old or older. And for the third year in a row, the number of respondents over the age of 70 was greater than 10% of total respondents, this year peaking at 20% of all respondents.

But for the first time during that period, there has been a spike in respondents 39 years old or younger. Perhaps most interesting in those figures for 2023 is a bump specifically in those 30 or younger (4%) while the 30 to 34 and 35 to 39 brackets had the lowest response rates (2% for each) overall. The largest age group was 60 to 69 (34%) with 50 to 59 (23%) coming second, making 70 and older the third largest age group of the survey.

When comparing that data to years of experience in the industry, things continue to get interesting as the second largest group of respondents (26%) had less than 10 years of experience. The largest respondent group indicate they had 30 years of experience or more (33%), which once again highlights the need for knowledge and skills transference as those with 10 years of experience or less continues to grow.

The data also suggest that some professionals have moved into the water industry later in life as a career change because the years of experience trend lower and the ages trend older. This inference opens up a conversation about targeting and messaging the correct people for workforce hiring and retention. Much focus has been placed on hiring Millennials and Gen Z workers, but perhaps a focus on Generation X and younger Baby Boomers looking for career changes after the pandemic could yield positive results for the industry at large.

Uncertainty in construction

Similar to 2022 and previous years, approximately 40% of utilities are not planning new construction of water or wastewater facilities in 2024. Year over year, there is a notable shift in those who responded undecided, as it doubled year over year from nearly 7% to 14%. For those who are planning new construction (45%), they are expecting it within the next 24 months. Last year, those planning new construction accounted for 51% of respondents.

A similar trend can be seen in those who are planning upgrades to existing facilities (55%) although the fervor of upgrading has subsided compared to last year (71%). Responses instead were split between those answering No (34%), which increased by 11 points year over year, and those answering Undecided (10%), which increased by 3 points year over year.

This uncertainty about future construction projects is alarming considering the federal investment in water and wastewater infrastructure. What it appears to point to are the regulations and policies surrounding construction regardless of that project being new or an upgrade.

In the drinking water sector, the per- and polyfluoroalkyl substances (PFAS) maximum contaminant levels are soon to be codified, nearly one year after being published for public comment in the spring of 2023. Those PFAS chemicals are also a concern for wastewater systems, but U.S. EPA has only published how to account for PFAS under current NPDES permitting. U.S. EPA Assistant Administrator to the Office of Water Radhika Fox said the agency intends to have a science-based risk assessment on PFAS in biosolids by the end of 2024, in line with the agency’s PFAS Strategic Roadmap.

Read the full article about U.S. EPA's PFAS Progress Report: wwdmag.com/33016549

Another point of uncertainty is Build America, Buy America, a law created by language in the Infrastructure Investment & Jobs Act that requires domestic preference for construction materials, iron and steel, and manufactured products for any federally funded infrastructure project. The manufactured products category is the primary sticking point for the water industry as much of the equipment is highly engineered with numerous components.

Original equipment manufacturers are still grappling with how to calculate 55% of their manufactured products to determine if they comply or do not comply. Worse yet, there are many pieces of water and wastewater treatment equipment that have never been manufactured in the U.S., as Europe and Asia tend to lead the world in innovative technologies for the industry.

Because compliance is uncertain, the certainty of construction is in the air for projects that are federally funded. This pressure will continue into 2024 and the pipeline of projects may begin to dry up as waivers expire and as delays in the clarity of what does and does not qualify continue to stretch. EPA did make a request for information from the water industry related to this issue toward the end of 2023, and Wastewater Digest encourages industry professionals to engage with the agency to share their perspectives on the matter.

Inflation & revenue

While the construction market is showing a degree of uncertainty, respondents showed an improvement in revenue year over year. In 2022, 53% of respondents indicated their revenue would increase, but data from the 2023 survey shows that only 36% saw that increase. The second largest group of respondents said revenue was about the same (34%) and 18% left this question unanswered. Looking into 2024, 46% of respondents believe their revenue will increase and 30% believe it will stay the same.

As revenues go up, prices often follow. And respondents to the survey were keen in identifying that as 87% said they expect to see bid prices increase in 2024 and 84% expect materials prices to increase. This is not very surprising given the state of the U.S. economy with interest rates remaining high between 7.5% and 8.5% for 30-year loans. The other driver is inflation, which has floated between 6% and 7% since 2021, although recent reports indicate inflation is declining.

While faced with these broad challenges, survey respondents still have a positive outlook. Many (63%) rated 2023 as a good year (37%), a very good year (21%) or an excellent year (5%). Looking at 2024, those expecting a good year (34%) showed a decline in favor of it being a very good year (26%) or an excellent year (9%). In both cases roughly 20% of respondents left the question blank.

Assuming the uncertainties holding up construction become more certain and inflation and interest rates continue to decline, it is possible that 2024 will witness the boom the industry has been expecting with that $50 billion in infrastructure funding signed for two years ago.

About the Author

Bob Crossen

Bob Crossen is the vice president of content strategy for the Water and Energy Groups of Endeavor Business Media, a division of EndeavorB2B. EB2B publishes WaterWorld, Wastewater Digest and Stormwater Solutions in its water portfolio and publishes Oil & Gas Journal, Offshore Magazine, T&D World, EnergyTech and Microgrid Knowledge in its energy portfolio. Crossen graduated from Illinois State University in Dec. 2011 with a Bachelor of Arts in German and a Bachelor of Arts in Journalism. He worked for Campbell Publications, a weekly newspaper company in rural Illinois outside St. Louis for four years as a reporter and regional editor. Crossen can be reached at [email protected].